Bootstrapping the Startup

Successful Bootstrapping is all about discipline and stamina. -- Kevin Hale

A financial plan is an integral part of business plan. Right from the beginning, startups should be aware of the requirements of funds at different stages and arrange funds accordingly.

Sources of Finance

1. Own funds- Bootstrapping

2. Debt

3. Angel Funding

4. Crowd Funding

5. Equity- Public Share holding

6. Venture Capital

FINANCING THE VENTURE

ü How much will be needed for further development of the product or service?

ü How much will be needed for setting up or expanding operations?

ü How much will be needed for Working Capital

ü Where will the money come from? What if more is needed?

Bootstrapping

The investment statistics shows that majority of startups invest their own money in the beginning.

The funds are sourced from family, friends or your own savings. This leaves you in complete control of business.

Boot Strapping Logic

v Small business startups ideas are yet to be fully accepted by the market. There is lack of steady revenue.

v In the early days of startup the entrepreneur wants full autonomy to try and establish his/her business..

v The money from any investor will come attached with strings.

v Customer Acquisition Process:

Startup ideas are mostly not unique and their focus is on creating superior service or a niche and hence the financial numbers will not attract external funding.

v Time Constraint:

The time resource is critical for startups and courting and managing external funding is of lesser priority than acquiring customers

v Hidden Cost of outside money and servicing the interest and capital

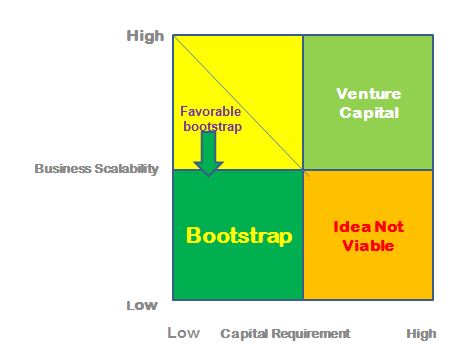

v Many startup ventures are poor fit to meet the venture capitalists’ criteria.

v Debt is also an option only when you have paying customers and steady revenue.

Recipe for Success (Courtesy Prof. Kumar- IIMB)

- Do not buy new what you can buy used

- Do not buy used what you can lease

- Do not lease what you can borrow

- Do not borrow when you can barter

- Do not barter when you can beg

- Do not beg when you can scavenge

- Do not scavenge what you can get for free

- Do not take for free what someone else will pay you for

- Do not take payment for something that people will bid for (create an auction)

Critical Success factors for Startups

- Focus on cash management ,not on profits

- Invest time in building network with bankers, investors right from the early days.

Exceptions for Bootstrapping

- Specialized Ventures requiring funds to build product

- High asset base requirement before even a trial product can be launched

- Requires hiring resources as startup entrepreneur may not have the required skills

Nuggets

- Minimize the lead time to start business

- Do not plan for aggressive growth

- Avoid Credit Sales unless you can devote time for follow up and collection of payments

- Build relations with your banker by channeling all your revenue through a bank.