Startup and Seed Funding

Startup and seed funding is a concept that anyone planning to start a venture but does not have sufficient capital, should look at for raising early stage funding.

The company may need funds for product development, marketing, hiring key resources and operational expenses.

Majority of startups use their own funds at the initial stages. Not all businesses can be funded with own capital as some ideas may require product development and testing.

Ideally seed funding should be sought only after gaining traction in the market. The proof of concept has to be established before a startup can seek funds.

There may be investors who see a large potential for the idea and may support the startup with funds to develop products and establish proof of concept. The credibility of a startup team should be high in terms of domain knowledge and skill sets. In reality it is very difficult to raise seed funds as the risks involved are quite high.

Image Source: Idea from freedigital photos

Expert Advice

Paul Graham -Founder Y Combinator-" Do Not raise money unless you want it and it wants you."

Startup and Seed Funding- Definition

Matthew Hollow- Academia

Seed money, sometimes known as seed funding or seed capital, is a form of securities offering in which an investor invests capital in exchange for an equity stake in the company. The term seed suggests that this is a very early investment, meant to support the business until it can generate cash of its own or until it is ready for further investments. Seed money options include friends and family funding, angel funding and crowd funding.

What is seed funding: Pitch Data Team

Seed funding, taken from the word "seed" is the capital needed to start / expand your business. It often comes from the company founders' personal assets, from friends and family or other investors.

The amount of money is usually relatively small because the business is still in the idea or conceptual stage.

Is Seed Funding the Right Answer for Your Startup?Gavin Christensen-Managing Partner of Kickstart Seed Fund

For startups, securing the first round of funding is a daunting process. Doing so requires founders to take what is often a very complex idea, product or solution, and boil it down to dollars and cents for investors who, for the most part, only care about how quickly they will make their money back. The process will test an entrepreneur's commitment to her idea while any and all unforeseen business issues are brought to light.

The life of an entrepreneur is rarely easy, but by taking a few extra steps, you can set yourself up for success and ensure that, if and when the time comes to secure funding, the growing pains of the seed stage will come as less of a shock and more of a boon to your overall success as an entrepreneur.

https://www.entrepreneur.com/article/310365

5 Ways for Startups to Get Seed Funding in India-Silicone India

The first step to hacking your seed round is identifying your investors and making a list.

The second step is to get introductions to them and talk about your company. The third step is to follow through, follow up and follow on.

https://www.siliconindia.com/news/startups/5-Ways-for-Startups-to-Get-Seed-Funding-in-India-nid-136721-cid-100.html

Startup and Seed Funding- Sources

The sources of seed funding include the startup team’s personal savings and investments from family and friends. Banks usually do not lend to startup companies because of high risks and venture capitalists tend to stay away from seed funding. However, a startup entrepreneur might have more success with angel investors and private equity funds. Angels are former entrepreneurs and other wealthy investors who get involved in some startup companies.

This type of funding is often obtained in exchange for an equity stake in the enterprise, although with less formal contractual overhead than standard equity financing.

Lenders often view seed capital as a risky investment by the promoters of a new venture, which represents a meaningful and tangible commitment on their part to making the business a success.

Startup and Seed Funding- Pre-Requisites

Bootstrap

2) Proof of Concept (need to prove that is a market for it + monetization methods)

3) Get your first customers and get feedback

4) Clear Milestones for the funds required

5) Pitch to potential Lenders

Startup and Seed Funding - Cases

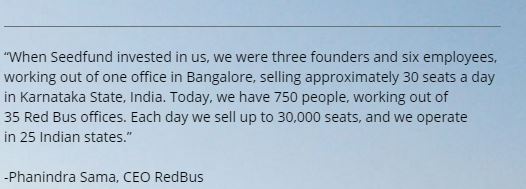

1. Redbus

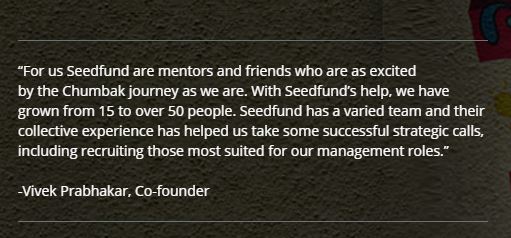

2. Chumbak

Startup and Seed Funding - Conclusion

In the present business climate, to obtain seed funds is difficult where investors want to minimize the risks. A good team, execution capabilities, innovativeness of the product and market potential still attract investors.

Seed funding investment can happen only if the startup team can demonstrate traction.

The following quote by Sriskandarajah at The Collective Elevator sums up how one can get seed funds

“Most companies need to understand who their potential end users are and the approximate market size. We do not back companies who aren’t solving a problem. If you don’t understand who your market is then you are not solving a problem, you are creating a solution and then hoping to find a problem.”